Business Valuation Service in Bahrain

Business valuation service in Bahrain refers to the process of determining the current worth of a business. There are many techniques used to determine the value of a business and conduct a business valuation. Business Valuation is conducted for several reasons like selling your business, looking for investors, or even to add shareholders.

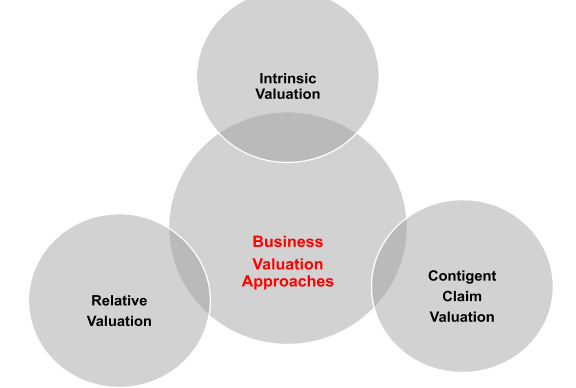

What are the three Business Valuation Approaches?

- Intrinsic valuation

Intrinsic Valuation relates the value of an asset to its intrinsic characteristics, its capacity to generate cash flows and the risk in the cash flows. In its most common form, intrinsic value is computed with a discounted cash flow valuation, with the value of an asset being the present value of expected future cashflows on that asset – in cases where cash flows are more predictive in the business.

- Relative Valuation

Relative Valuation estimates the value of an asset by looking at the pricing of ‘comparable’ assets relative to a common variable like earnings, cashflows, book value or sales.

- Contingent Claim Valuation

Contingent Claim Valuation uses option pricing models to measure the value of assets that share option characteristics.

What are the different Methods used for Business Valuation?

There are three fundamental ways and other methods to measure the value of a business based on the above three approaches:

- Asset methods

- Market methods

- Income methods

- Other methods

Under each approach, there are a number of methods that are available which can be used to determine the value of a business enterprise. Each business valuation method uses a specific procedure to calculate the business value.

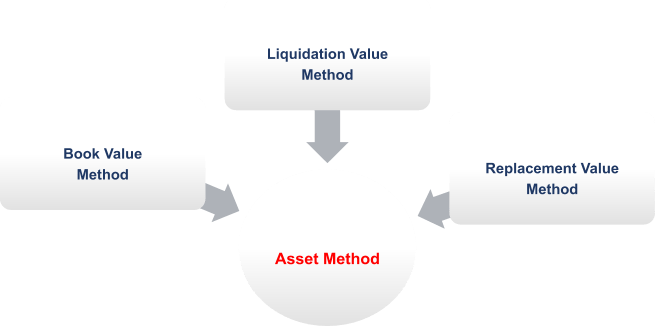

Asset Method

The Asset Method approach while conducting business valuation considers the underlying business assets in order to estimate the value of the overall business enterprise. This kind of approach relies upon the economic principle of substitution and obtains to estimate the costs of forming a business of equal economic utility, which means a business that can produce the same returns for its owners as the subject business.

The business valuation methods under the Asset Approach are as follows:

- Book value method

- Liquidation value method

- Replacement value method

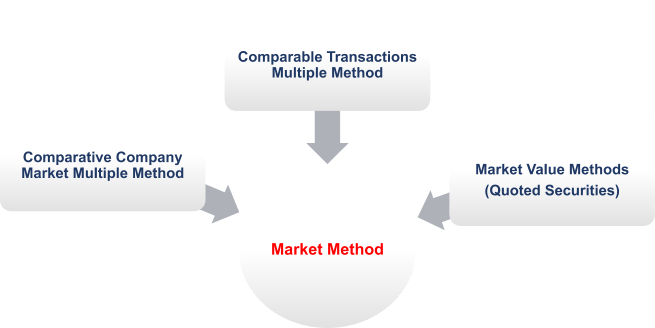

- Market Method

The Market Approach to business valuation refers to the marketplace for indications of a business value. Sales of similar businesses are studied to collect comparative evidence. This comparative evidence can be used to estimate the value of the subjected business. The Market Approach uses the economic principle of competition which obtains to calculate the value of a business in comparison to similar businesses whose value has been recently established by the market.

The business valuation methods under the Market Approach are:

- Comparative company market multiple method

- Comparable transactions multiple method

- Market value methods (Quoted securities)

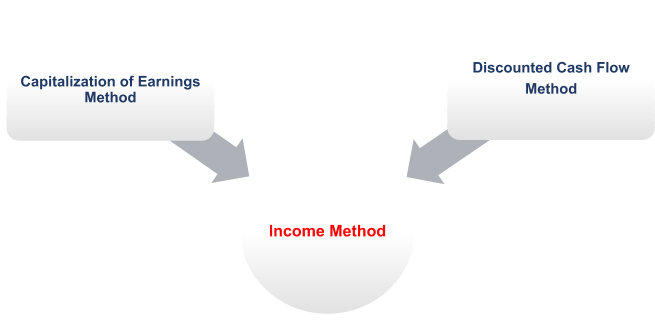

Income Method

The Income Approach to business valuation applies the economic principle of expectation to define the value of a business. Estimation of the future returns for the business owners can be expected to receive from the subject business. These returns are then matched against the risk associated with receiving them fully and on time.

The returns are calculated as either a single value or a stream of income expected to be received by the business owners in the future. The risk is then quantified by so-called capitalization or discount rates.

The method which rely upon a single measure of business earnings are known as direct capitalization method. Those methods that utilize a stream of income are known as the discounting methods. The discounting methods account for the time value of money directly and determine the value of the business enterprise as the present value of the projected income stream.

The methods under the Income Approach include:

- Price to Earnings or Earnings Multiple/Capitalization of Earnings Method

- Discounted Cash Flow Method

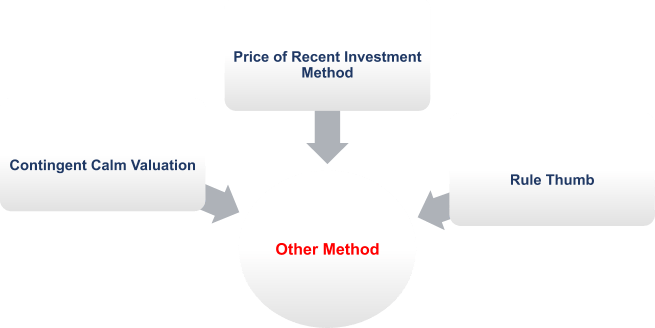

Other Methods

- Contingent claim valuation

- Price of recent investment method

- Rule of thumb

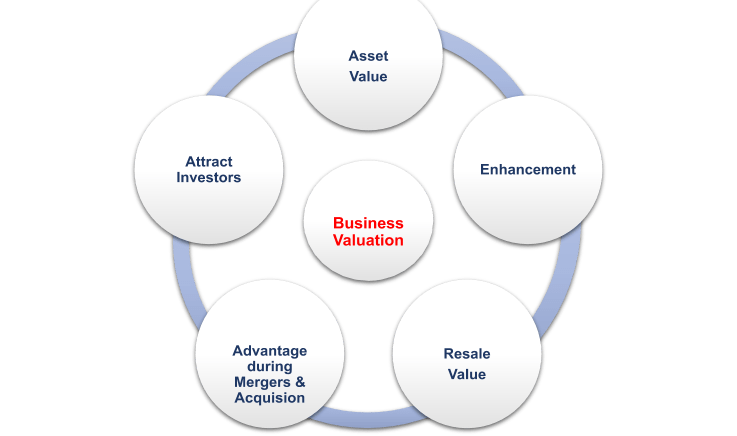

Looking to Grow your Business – How Business Valuation Can Outgrow Your Business?

Precise Knowledge of your Asset:

Once a business valuation is conducted, it provides precise and reliable facts and figures with regard to the actual worth or value of the business in terms of market competition, asset values, and income values knowing the actual worth of your asset.

Enhancement of Business:

The moment you get a precise idea on the worth of your business, it will definitely enhance the business in present market conditions with the asset values and income values.

Resale Value of your Business:

If you are looking to sell your business, knowing the true value of your business is necessary. Hence, the business valuation process should be progressed months before you actually start looking for buyers.

Advantage during Mergers or Acquisitions:

At times when there are serious buyers of your business, you should be able to show the value of your business a whole, what its asset withholdings are, how it has progressed and grown and how it can continuously thrive for growth. Only when you know what your actual business valuation really is, you are able to negotiate your business well and be an advantage at the time of merger or acquisitions.

Attract Investors:

Business Valuation provides the worth of your business, and that is exactly what the investor will be looking for, a full Company Valuation Report.

How can Emirates Chartered Accountants Group Help you with Business Valuation Service in Bahrain?

Emirates Chartered Accountants Group houses highly efficient and professionally well-equipped qualified professionals in the related field of work. While providing Business Valuation Service in Bahrain to your business, the service demands a high level of financial analysis which should be undertaken by a qualified valuation professional with the appropriate credentials only.

As such, our well qualified professionals provide Business Valuation Services in Bahrain since inception and we understand that each business is different. That is why we always have special tailored approaches for every single entity.

Emirates Chartered Accountants Group offers support to the business community in Bahrain with meticulousness in compliance with all the rules and regulations.

Talk to our Expert, we are happy to support!

Mr. Bichin

Asst. Manager, Bahrain Operations

+973 3619 8998