What are the Eligibility Criteria for VAT Registration in Bahrain?-EmiratesCA Group

- November 17, 2019

- Posted by:

- Category: Tax

VAT Registration in Bahrain is applicable for both resident and non-resident persons who conduct economic activity in the region. In this blog content, we will discuss the importance of VAT Registration in the Kingdom of Bahrain. VAT Registration in Bahrain was started in the last quarter of the year 2018. However, the effective date of VAT Implementation was 1st January 2019. VAT registration was mandatory from this date only for companies having a higher turnover. Companies which are having lesser turnover were asked to register under Bahrain VAT during the year 2019. A detailed explanation of the eligibility criteria for VAT registration is described in the below paragraphs.

What are the eligibility criteria for VAT Registration in Bahrain?

Companies should mandatorily opt for VAT Registration in Bahrain if they are having a turnover (taxable supplies) of more than 37,500/- BHD for the past 12 months or is expected to have a turnover (taxable supplies) of more than 37,500/- BHD in the coming 12 months.

At the same time, businesses in Bahrain also have an option to Voluntarily Register for VAT in Bahrain. If a business in Bahrain made a turnover (taxable supplies) of more than 18,750/- BHD but less than 37,500/- BHD in the past twelve months, they can apply for VAT Registration under voluntary option. At the same time if a company is expecting a turnover (taxable supplies) more than 18,750- BHD but less than 37,500 BHD in the next twelve months, in such cases also it can opt for voluntarily registered for VAT in Bahrain.

In Bahrain VAT Registration has taken place in 3 stages:

- Category first is those companies that are having higher turnover (taxable supplies) ie; more than 5,000,000/- Million BHD for a period of 12 months. They were supposed apply for registration by 20th December 2018 and were supposed to get ready to collect and pay VAT to the Tax Authority in Bahrain – National Bureau of Revenue with effect from 1st January 2019.

- Companies which are having a turnover (taxable supplies) for a consecutive period of twelve months for more than 500,000/- BHD but is less than 5,000,000/- Million BHD then they have to apply for VAT registration by 20th June 2019 and get ready to collect VAT from 1st July 2019.

- Small, Medium and Micro-Level Companies that are having turnover (taxable supplies) less than 500,000 BHD for a period of twelve months are the rest. They had to apply for VAT Registration on or before 20th December 2019 and get ready to collect VAT from 1st January 2020.

How to calculate the turnover for considering VAT Registration in Bahrain?

In order to arrive at the turnover for VAT Registration, the company has to consider only the taxable supplies. Such taxable supplies include:

- Standard Rated Supplies

- Zero Rated Supplies

- Goods and Services under Reverse Charge Mechanism (RCM)

Value of Exempted supplies and out of scope supplies will not be a forming part of the above turnover calculation.

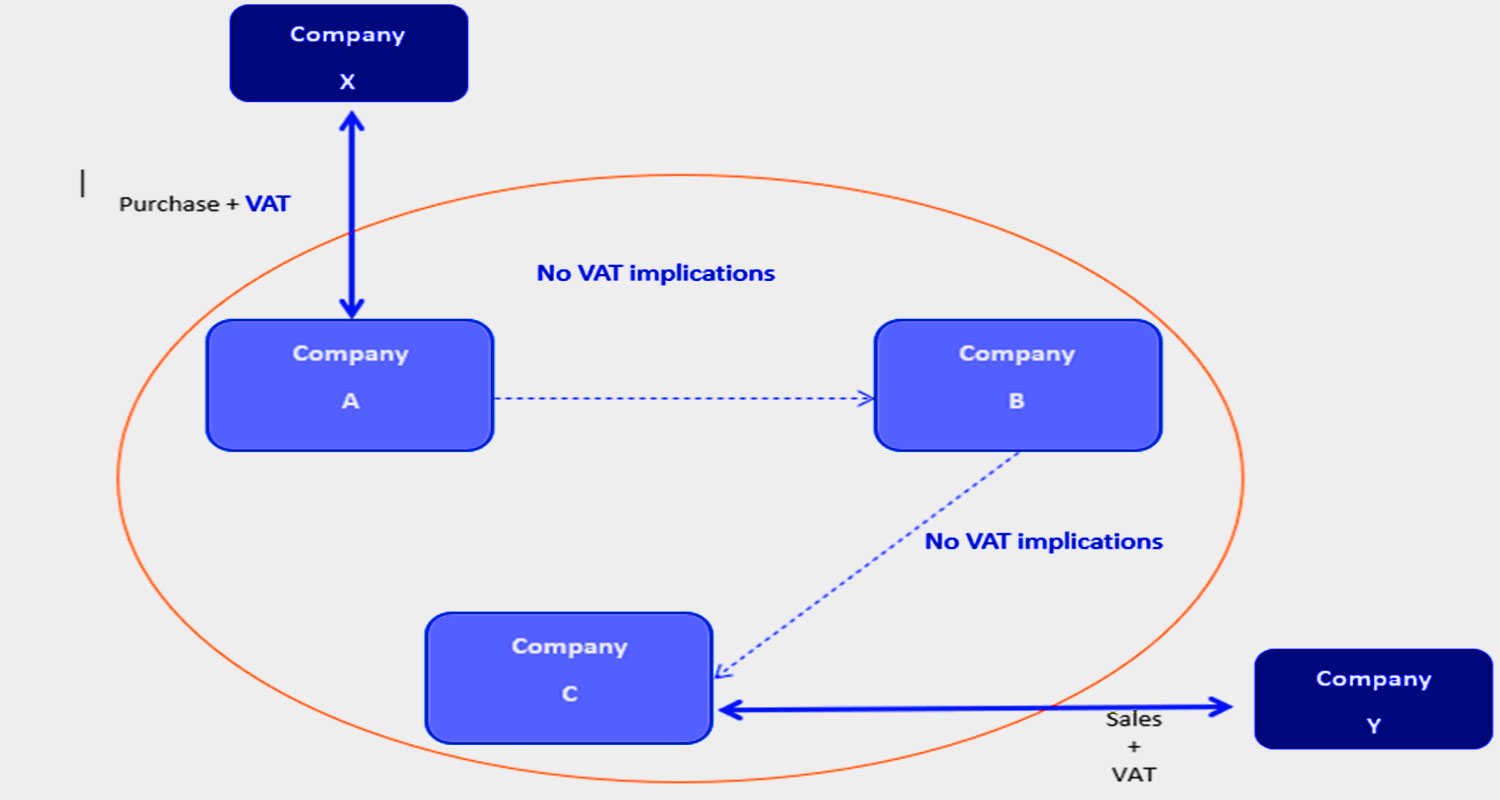

VAT Group Registration in Bahrain

Entities can register as a VAT Group if:

- Each person has a place of establishment or a fixed establishment in the Kingdom of Bahrain

- The persons are “related parties” and

- Either one person controls others or two or more persons conducting business in partnership control the others.

Entities within one VAT Group are treated as one entity for the VAT purpose.

Supplies made between members of a VAT Group are disregarded from VAT.

One entity cannot be part of more than one VAT group.

Tax Group Structure

What if you do not register for VAT in Bahrain?

If you do not comply with the Bahrain VAT Law and fail to register for VAT in Bahrain, you are inviting huge penalties of non-compliance of the law. If you fail to register under Bahrain VAT law, within the due date as prescribed by the authority (by 1st January 2019 OR 1st July 2019 OR 1st January 2020 as the case may be) the penalty will be BHD 10,000/.

If you failed to apply for registration within 60 days from such due date for registration, you are supposed to register; then the penalty for delay for deregistration may extend to imprisonment up to 3 – 5 years.

How to Register For VAT in Bahrain?

VAT Registration in Bahrain is an online process and is accessible in the NBR site online portal. To proceed with VAT Registration in Bahrain please click

What are the documents required to register for VAT in Bahrain?

The documents that are required to register for VAT in Bahrain is as follows:

- Copy of Commercial Registration Certificate

- Independent Auditors Report

- Audited Financial Statement

- Expense Budget Report

- Proof of relationship between HQ and Subsidiary

- Customs Registration Certificate

- Copy of Association/Partnership agreement

- Copy of Certificate of Incorporation

- Copy of Personal Identification of The Designated Person

It should be ensured that all the figures submitted to NBT shall be accompanied by the proper supporting documents

If you want to learn through the video please go through it.

Emirates Chartered Accountants offer VAT Services in the Kingdom of Bahrain. Our tax officers are professionally equipped and well versed with the Bahrain VAT laws and have in-hand experience of handling VAT in other GCC countries.

Emirates Chartered Accountants provides one of the best VAT Services Bahrain possessing a wide array of services. Even before the implementation VAT of Bahrain, we have been serving our UAE clients since the inception of VAT in UAE from 1st January 2018 with 100% happy customers.

Our VAT Services in Bahrain are:

- VAT Registration

- VAT Training

- VAT Implementation

- VAT Return Filing

- VAT Consultancy

- Accounting for VAT Compliance

| For TAX Service in Bahrain

Mr. Bichin +973 3619 8998 |

For TAX Service in UAE

Mr. Navaneeth +971 55 889 2750 |