VAT Return Filing in Bahrain| Can You Modify the VAT Returns You Have Submitted?

- September 19, 2019

- Posted by:

- Category: Tax

VAT Return filing in Bahrain there are two way to modify the VAT Returns you have already submitted through the National Bureau for Revenue online portal. This article will teach you detailed steps to modify the VAT returns that you have submitted.

Businesses who have registered for VAT in Bahrain are obliged to file their VAT Return on the specific period as prescribed by the National Bureau for Revenue (NBR) which is an online process.

The VAT Return filing in Bahrain for businesses either be can be on a quarterly basis or on a half-yearly basis as of 2019 depending on their turnover. From the next year, 2020 NBR has prescribed that it will be a monthly basis or on a quarterly basis.

Can you Modify the VAT Returns you have submitted?

After you have completed your VAT Return Filing and have come to know later that an adjustment is required or there is a mistake in your VAT Return, in such case, the VAT Registered businesses in Bahrain are obliged to inform the NBR and make necessary amendments. As per the Bahrain VAT Law, modifications in your VAT Return should arise within the period of 5 years from the date of filing the return which is subject to the modification.

When can you Modify the VAT Returns you have submitted?

- If there is a change in your already recorded transactions.

- If there is an Internal Error.

The NBR has every right to conduct an assessment of a submitted VAT return for those businesses in Bahrain who has registered for VAT.

How can you Modify the VAT Return?

VAT Returns has to be modified and completed through the National Bureau for Revenue (NBR) online portal. There are two ways to modify the VAT Returns you have already submitted.

1. If there is a change in your already recorded transactions your VAT Return can be modified by means of adjustment

2. If there has been an error internally then the VAT Returns should be modified through corrections or self-amendments.

If adjustment of input VAT is for Capital Assets, in such cases it should be adjusted as per the provisions of Article 60 of the Bahrain VAT Law.

- If there is a change in your already recorded transactions of VAT Return and you have opted for Adjustment, you should note that, the modification must be done in the VAT return of that particular VAT period in which the change has occurred.

In case the adjustment is not done in that particular VAT period where change has occurred then the VAT payer should submit a correction or self-amendment to modify the error that has been made.

Once you complete with filling the details in the “VAT Return Form” of the current period necessary amendments or modifications should be made in the “Adjustment / Apportionment (BHD)” column.

Below is the figure is shown for Input VAT where your adjustment is to be made which is highlighted in RED.

Below is the figure is shown for Output VAT where your adjustment is to be made which is highlighted in RED.

If any adjustments are being made by businesses in Bahrain who are obliged to pay VAT it is suggested that the submitted adjustments are supported with an explanation or you can also submit the documents associated with the modification made. Such kind of information should be uploaded in the “Additional Information” as shown in the below image.

- If there has been an error internally then the VAT Returns should be modified through corrections or self-amendments and there will be penalties levied to those who uses the self-amendment form.

But if the internal error which has occurred amounts to less than BHD 5,000/-, then it can be modified as a correction in the VAT return of the following VAT period. The correction should be made in the line no. 15 “Corrections from the previous period” shown in the below image once the details in the “VAT Return Form” of the current VAT period is completed.

If any adjustments are being used by businesses in Bahrain who are obliged to pay VAT it is suggested that the submitted adjustments are supported with an explanation or you can also submit the documents associated with the modification made. Such kind of information should be uploaded in the “Additional Information”.

When can a VAT payer use “Self-Amendment”?

Option 1: when a VAT payer seeks for immediate modification and does not want to wait for the next period.

Option 2: when a VAT payer makes an internal error where the net VAT due is equal to or greater than BHD 5,000/-. When a VAT payer notices the error too late and where it cannot be reported in the following VAT period.

Option 3: when a VAT payer fails to submit a VAT return for a given VAT period and issues an estimated assessment in which the net VAT due for that given VAT period is determined by NBR. NBR will grant the VAT payer a defined period to self-amend the assessment before is it deemed final and binding.

steps for Self – Amendment

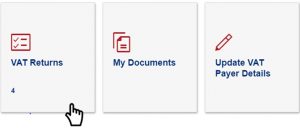

Step 1:

Login to the NBR Portal with your valid user id and password. Click on the VAT Return as shown in the image below.

Step 2:

You will be redirected to a page where you will see all your VAT Returns which has not yet been filed. Filter your “VAT Return Form” and select “Billed” from the drop-down menu as shown in the below image.

Step 3:

Now you will have to choose that particular VAT return period for which you would like to submit the self-amendment. Below image for reference.

Step 4:

To make any amendments make sure you click the amend button as shown in the below image. Make sure that you have all the necessary information which is required as the progress will not be saved.

Choose the aptest reason for the amendment.

Step 5:

A self-amendment should include descriptions of the amended amounts, the original amounts, the differences as a result and the reason for the modification. This information should be uploaded as attachments or written in the “Additional notes” box found in the “Additional Information” section of the application as shown in the below image.

Step 6:

Once you complete the self-amendment and you agree to the declaration you will be able to review and submit your self-amendment.

The submission will be acknowledged instantly and you will be receiving an email and SMS.

VAT Services in Bahrain

Emirates Chartered Accountants in Bahrain Branch provides everything you need to run a smooth flow of your business. Our wide range of professional services comes with a cost-effective and tailor-make option that is preferred by businesses all over. Our team of professionals is well versed with the Bahrain VAT Law as well as the UAE VAT Law. They are also equipped with practical experience of implementing VAT in UAE and VAT in Bahrain.

Our wide range of services includes:

- VAT Registration

- VAT Training

- VAT Implementation

- VAT Return Filing Service

- VAT Consultancy

- Accounting for VAT Compliance

You may reach our Executives:

|

For TAX Service in Bahrain Mr. Bichin +973 3619 8998 |

For TAX Service in UAE Mr. Navaneeth +971 55 889 2750 |